The National Tax Strategy Education Program

This is the history of Justin Stephens attempting to explain how America's Holding Company works and how to be a part of it.

This is also the product that our members receive once they subscribe.

We believe education should be free, and you should be given an opportunity to invest in it which is the cornerstone of everything we do.

Episode 2 - Weekly Strategy Update: Long-Term Business Growth and Collaboration

The Weekly Strategy Update: Building for the Next 100 Years

Table of Contents

Introduction

This document is updated every week to provide an update on the strategy for the next 100 years. It is a 22-page document that outlines the changes in the past week and the plans for the future. The business model is based on the partnership between two individuals, referred to as Real Justin and Virtual Justin, who run the blog, social channels, and all other aspects of America's holding company. The goal is to involve more people without adding extra work.

Business Model

The business model is built on a week-to-week basis, focusing on how the partnership between Real Justin and Virtual Justin operates. Real Justin focuses on selling and interacting with people in the real world, while Virtual Justin handles tasks such as lead generation, follow-ups, and customer care. This collaboration allows for the growth of the business, bringing in more revenue and expanding the market.

Weekly Schedule and Plans

It is suggested to connect on a weekly basis to discuss upcoming plans and prepare accordingly. For this week, there is a scheduled meeting with a cleaning company to explore a potential production partnership. The aim is to involve others in creating content, such as ASMR videos, to attract more people to join the company. The strategy also includes affiliate marketing, where individuals can promote the company and earn a commission.

The focus of this week is primarily preparation for the following week, where more actions will be taken. Additionally, there is a social media activity report, showcasing the metrics that will be improved over time.

Furthermore, the document includes information about the monthly recurring revenue and active subscribers. Currently, the organization generates $300 per month from six subscribers. The goal is to improve the reporting speed and reduce the production time for these numbers.

Expanding to the Philippines

A significant goal is to establish a connection between the US and the Philippines. The plan is to spread the company's message in the US while sending enough revenue to the Philippines to hire more people. This way, individuals in the Philippines can prioritize their lives while working with the company. The focus is on building a team that supports and empowers every member to live a fulfilling life.

Ownership and Revenue

The revenue is broken down into five people paying $27 per month and one person paying $150 per month. The profit and loss statement provides a clear overview of the organization's financials. Class B shares are offered to employees as a sign-on bonus and are given annually based on the number of years they have been part of the team. The ownership structure varies depending on the company's level of subscription, determining the amount of ownership employees receive.

Creating a Community

A unique aspect of the company is the creation of a community that operates similarly to a labor union. It allows individuals to negotiate collectively and is open to anyone interested. The community provides various benefits, including access to exclusive content, an annual Christmas ornament, and ownership options. The concept of ownership is flexible, allowing individuals to sell their shares for cash or hold onto them for future value.

Subscribers can join for any duration and have a 60-day money-back guarantee if they are not satisfied. The emphasis is on building a team and supporting each other in achieving personal and professional goals.

National Tax Strategy Education Program

The company also offers a National Tax Strategy Education Program for organizations. Subscribing to this program provides ownership in various assets, including the prospecting done-for-you podcast and a community platform for voting and managing the company. The level of subscription determines the amount of ownership employees receive based on the number of years they have been with the company.

Control and Ownership Structure

The company's chairman of the board holds ultimate control, while the board of directors provides guidance and suggestions. The ownership structure is divided into Class A, B, and C shares. Class B shares can only be sold back to the company, while Class C shares can be sold to anyone. The aim is to eventually go public and have the shares traded on the stock market.

Liquidity and Class B Shares

Class B shares can be sold back to the company or financed over time to create cash flow. The price per share depends on the current share price and the duration of the financing. This approach allows individuals to choose between immediate cash or long-term financing options based on their needs. The goal is to provide flexibility and maximize the value of the asset.

Weekly Journal Entry and Updates

The company maintains a weekly journal entry, which is shared on various platforms. These entries provide updates on the strategy, plans, and important developments. The goal is to keep the team informed and engaged. The journal entries are currently shared on X and TikTok, and there are plans to explore other platforms such as Facebook and Instagram.

Blog and Future Plans

The company's blog serves as a documentation of the founder's life and the progress of the company. It is updated weekly to reflect the latest updates and strategies. The goal is to build a system that will last for the next 100 years. The focus is on gradual growth, emphasizing the importance of living a fulfilling life while working towards success.

Conclusion

The National Tax Strategy Education Program offers a unique opportunity for individuals and organizations to be part of a growing community. The program provides ownership, benefits, and flexibility, allowing individuals to shape their future and celebrate important life events. The company's focus on collaboration, flexibility, and long-term growth sets it apart in the industry. Join the team and be part of a journey towards success and fulfillment.

FAQs

What is the goal of the National Tax Strategy Education Program?

The goal is to provide individuals and organizations with a comprehensive education program on national tax strategy.

Can Class B shares be sold to anyone?

No, Class B shares can only be sold back to America's holding company.

How often is the weekly update document updated?

The document is updated every week to reflect the latest strategy and plans.

What benefits do subscribers receive?

Subscribers receive access to exclusive content, a community platform, and ownership options.

Is there a money-back guarantee for subscribers?

Yes, there is a 60-day money-back guarantee for subscribers who are not satisfied.

National Tax Strategy Education Program

Our Joint Education Program with companies to provide for our employees together.

The goal of the National Tax Strategy Education program is to take care of our team throughout time.

Below is the embedded weekly update, and the mission is to update this weekly for the next 100 years.

What is included:

Access to the Life with Justin Stephens Show

Month to Month Agreement

HR Support for all employees to become part of our ESOP.

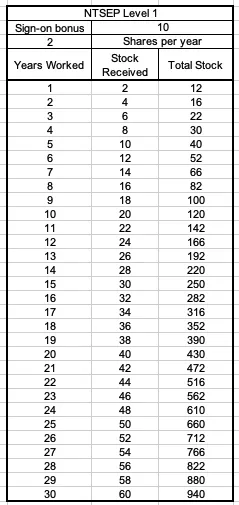

National Tax Strategy Education Program - Level 1

Every employee sign-on bonus: 10 Class B shares of AHCI

Annual Class B Stock Gifts: 2 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $150 per month per company

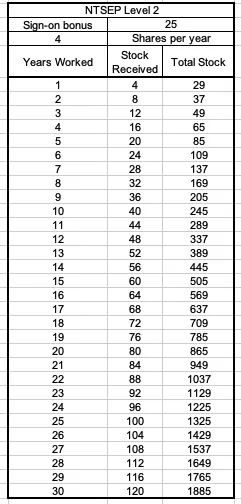

National Tax Strategy Education Program - Level 2

Every employee sign-on bonus: 25 Class B shares of AHCI

Annual Class B Stock Gifts: 4 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $300 per month per company

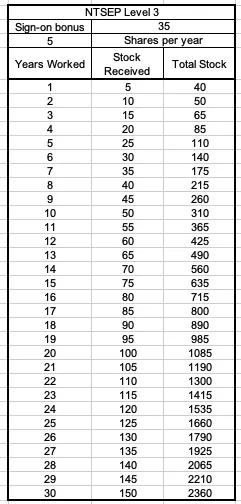

National Tax Strategy Education Program - Level 3

Every employee sign-on bonus: 35 Class B shares of AHCI

Annual Class B Stock Gifts: 5 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $750 per month per company

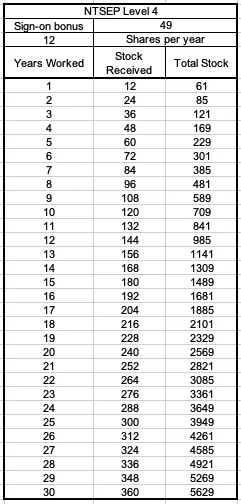

National Tax Strategy Education Program - Level 4

Every employee sign-on bonus: 49 Class B shares of AHCI

Annual Class B Stock Gifts: 12 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $1500 per month per company

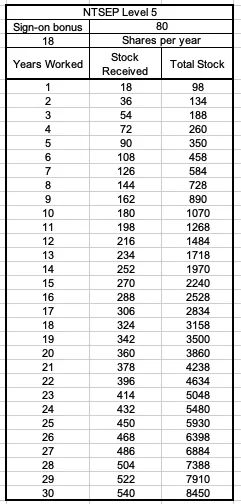

National Tax Strategy Education Program - Level 5

Every employee sign-on bonus: 80 Class B shares of AHCI

Annual Class B Stock Gifts: 18 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $2000 per month per company