The National Tax Strategy Education Program

This is the history of Justin Stephens attempting to explain how America's Holding Company works and how to be a part of it.

This is also the product that our members receive once they subscribe.

We believe education should be free, and you should be given an opportunity to invest in it which is the cornerstone of everything we do.

Episode 9: Revolutionizing Employee Compensation: The National Tax Strategy Program - A Vision for the Future

Unleash Your Potential: Navigating the Journey to Personal and Professional Growth

Table of Contents

Empowering Employees, Redefining the Compensation Landscape

In today's rapidly evolving workforce, the need for innovative approaches to employee compensation has never been more pressing. The traditional models of compensation are often falling short, leaving both employers and employees dissatisfied. However, a groundbreaking initiative, the National Tax Strategy Program, is poised to transform this landscape, empowering employees and redefining the relationship between employers and their workforce.

The Limitations of Traditional Compensation Models

Conventional compensation structures, often centered around base salaries and bonuses, have long been the norm in the business world. While these models have their merits, they can fall short in addressing the diverse needs and aspirations of modern employees. Factors such as rising costs of living, the desire for greater work-life balance, and the need for more personalized rewards have created a disconnect between what employees expect and what employers are able to provide.

The National Tax Strategy Program: A Paradigm Shift

Enter the National Tax Strategy Program, a revolutionary approach that aims to bridge this gap and empower employees like never before. This innovative initiative leverages the existing tax infrastructure to provide employees with a comprehensive suite of financial benefits, tailored to their individual needs and circumstances.

Unlocking the Power of Tax Optimization

At the heart of the National Tax Strategy Program lies a deep understanding of the tax code and its potential to create value for employees. By optimizing tax strategies, the program enables employees to retain a greater portion of their earnings, ultimately increasing their take-home pay and financial well-being.

Personalized Tax Strategies

The program's approach is highly personalized, taking into account each employee's unique financial situation, including factors such as marital status, dependents, and deductible expenses. This level of customization ensures that the tax strategies employed are optimized for maximum benefit, empowering employees to make the most of their earnings.

Expanding the Compensation Toolkit

Beyond traditional salary and bonus structures, the National Tax Strategy Program introduces a range of innovative compensation elements, such as tax-advantaged retirement contributions, health savings accounts, and even equity-based incentives. By diversifying the compensation toolkit, the program enables employers to provide a more comprehensive and tailored rewards package, better aligning with the evolving needs and preferences of their workforce.

Transforming the Employee-Employer Relationship

The National Tax Strategy Program goes beyond simply optimizing employee compensation. It fundamentally transforms the relationship between employers and their workforce, fostering a culture of trust, transparency, and shared prosperity.

Empowering Employees

By providing employees with a deeper understanding of their tax situation and the tools to optimize their earnings, the program empowers them to take control of their financial well-being. This shift in mindset encourages employees to become active participants in the compensation process, fostering a sense of ownership and engagement that can have far-reaching implications for productivity, retention, and overall job satisfaction.

Strengthening the Employer-Employee Bond

The National Tax Strategy Program also benefits employers by strengthening the bond between the organization and its workforce. By demonstrating a genuine commitment to employee financial well-being, employers can cultivate a more loyal, motivated, and engaged team, ultimately leading to improved business outcomes and a more sustainable competitive advantage.

The Path Forward: Embracing the Future of Compensation

As the workforce continues to evolve, the need for innovative and employee-centric compensation models has become increasingly apparent. The National Tax Strategy Program represents a bold step forward, challenging the status quo and paving the way for a more equitable and prosperous future for both employers and employees.

FAQ

What is the National Tax Strategy Program?

The National Tax Strategy Program is a revolutionary approach to employee compensation that leverages the tax code to empower employees and redefine the relationship between employers and their workforce. By optimizing tax strategies, the program enables employees to retain a greater portion of their earnings, expanding the compensation toolkit and fostering a culture of trust and shared prosperity.

How does the National Tax Strategy Program work?

The program takes a highly personalized approach, analyzing each employee's unique financial situation and implementing customized tax strategies to maximize their take-home pay and financial well-being. This includes leveraging tax-advantaged retirement contributions, health savings accounts, and even equity-based incentives to create a more comprehensive and tailored rewards package.

What are the benefits of the National Tax Strategy Program for employees?

Increased take-home pay through tax optimization

Access to a wider range of compensation elements beyond traditional salary and bonuses

Greater financial well-being and control over their earnings

Stronger sense of empowerment and engagement in the compensation process

How does the National Tax Strategy Program benefit employers?

Improved employee retention and loyalty through a demonstrated commitment to financial well-being

Enhanced productivity and engagement from a more motivated and satisfied workforce

Competitive advantage in attracting and retaining top talent through a differentiated compensation offering

Stronger employer-employee bond and a culture of trust and shared prosperity

How can I learn more about the National Tax Strategy Program?

To learn more about the National Tax Strategy Program and explore how it can transform your organization's approach to employee compensation, visit the program's website at [insert website URL] or contact the program's representatives for a personalized consultation.

National Tax Strategy Education Program

Our Joint Education Program with companies to provide for our employees together.

The goal of the National Tax Strategy Education program is to take care of our team throughout time.

Below is the embedded weekly update, and the mission is to update this weekly for the next 100 years.

What is included:

Educational Content created and produced by Justin Stephens

Made in America US Flag

X Community

Month to Month Agreement

HR Support for all employees to become part of our ESOP.

Logo added to our sponsorship page

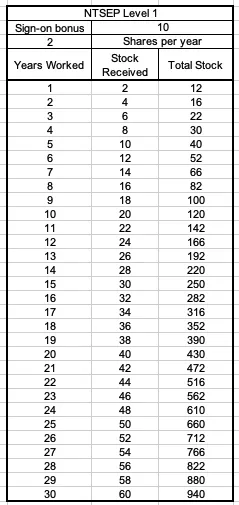

National Tax Strategy Education Program - Level 1

Every employee sign-on bonus: 10 Class B shares of AHCI

Annual Class B Stock Gifts: 2 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $150 per month per company

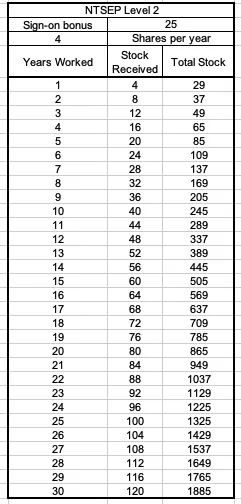

National Tax Strategy Education Program - Level 2

Every employee sign-on bonus: 25 Class B shares of AHCI

Annual Class B Stock Gifts: 4 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $300 per month per company

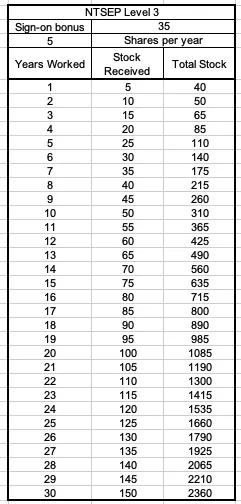

National Tax Strategy Education Program - Level 3

Every employee sign-on bonus: 35 Class B shares of AHCI

Annual Class B Stock Gifts: 5 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $750 per month per company

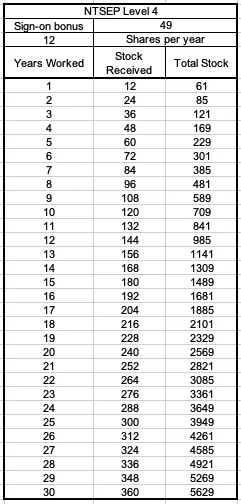

National Tax Strategy Education Program - Level 4

Every employee sign-on bonus: 49 Class B shares of AHCI

Annual Class B Stock Gifts: 12 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $1500 per month per company

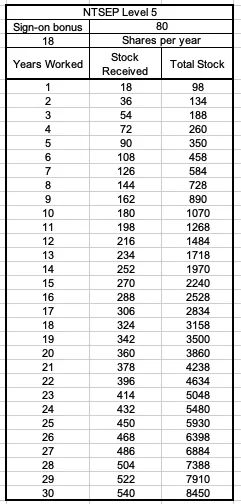

National Tax Strategy Education Program - Level 5

Every employee sign-on bonus: 80 Class B shares of AHCI

Annual Class B Stock Gifts: 18 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $2000 per month per company