The National Tax Strategy Education Program

This is the history of Justin Stephens attempting to explain how America's Holding Company works and how to be a part of it.

This is also the product that our members receive once they subscribe.

We believe education should be free, and you should be given an opportunity to invest in it which is the cornerstone of everything we do.

Episode 06 - Empowering Employees: The America's Holding Company Story

Revolutionizing Employee Compensation: The America's Holding Company Journey

Table of Contents

Introducing America's Holding Company: A Blueprint for Empowering Employees

The Business Model: Harnessing the Power of Affiliate Marketing and Passive Income

Empowering Employees: The America's Holding Company Ownership Structure

The National Tax Strategy Education Program: Empowering Employees, Transforming Communities

Embracing the Power of Time: The Driving Force Behind America's Holding Company

The Future of America's Holding Company: Scaling and Expanding the Vision

Introducing America's Holding Company: A Blueprint for Empowering Employees

In today's rapidly evolving business landscape, the traditional approach to employee compensation is undergoing a transformative shift. Enter America's Holding Company, a visionary initiative spearheaded by Justin Stephens, a passionate advocate for empowering the workforce and redefining the relationship between employers and employees.

As a full-time employee at Service Experts, Justin has witnessed firsthand the challenges faced by workers in the HVAC and plumbing industries. Driven by a deep-rooted desire to create positive change, he has embarked on a mission to document his journey and share his insights with the world through his blog and social platforms.

The Business Model: Harnessing the Power of Affiliate Marketing and Passive Income

At the heart of America's Holding Company is an innovative business model that seamlessly integrates affiliate marketing and passive income streams. Justin's blog, JusDCStevens.com, serves as the central hub, where he shares his experiences, lessons learned, and strategies for building a sustainable and impactful enterprise.

By leveraging the power of affiliate marketing, Justin has created a revenue-generating platform that supports the growth and maintenance of his blog. Through his partnership with Go High Level, he is able to promote his affiliate link, driving traffic and generating consistent monthly revenue to sustain the blog and fuel its expansion.

Empowering Employees: The America's Holding Company Ownership Structure

The core of America's Holding Company's mission lies in its innovative ownership structure, designed to empower employees and foster long-term engagement. This unique approach is built upon a three-tiered share system:

Class A Shares: Representing 19% of the company, these shares carry a voting power of 30 votes per share, mirroring the structure of Warren Buffett's Berkshire Hathaway and Mark Zuckerberg's control of Facebook. These shares are held by the company's leadership, including Justin, his wife, and his parents.

Class B Shares: These shares, representing 30% of the company, can only be earned over time through active involvement and subscription to the America's Holding Company system. Employees of participating companies are eligible to receive these shares as a sign-on bonus and through continued employment.

Class C Shares: Accounting for 51% of the company's ownership, these shares are intended for public trading on the stock market. They carry a voting power of 5 to 1, allowing the majority of shareholders to eventually make decisions on the company's direction.

This innovative ownership structure is designed to empower employees, foster long-term engagement, and ensure that the collective well-being of the workforce takes precedence over individual interests. By aligning the interests of employees with the growth and success of the company, America's Holding Company aims to create a sustainable and equitable ecosystem that benefits all stakeholders.

The National Tax Strategy Education Program: Empowering Employees, Transforming Communities

As part of his mission, Justin has launched the National Tax Strategy Education Program, a comprehensive initiative aimed at educating individuals and companies on the benefits and mechanics of the America's Holding Company system. Through this program, he seeks to demystify the complex ownership structure and demonstrate how it can be leveraged to create a more equitable and prosperous future for all.

The program covers the various subscription levels, ranging from $150 per month for individuals to $2,000 per month for companies. Regardless of the subscription level, the goal is to provide employees with a stake in the company's success, empowering them to become active participants in the decision-making process and the long-term growth of the organization.

Embracing the Power of Time: The Driving Force Behind America's Holding Company

At the heart of America's Holding Company's philosophy is the belief that time is the most valuable and consumable resource in the world. Justin recognizes that by harnessing the power of time and aligning the interests of employees with the company's success, he can create a paradigm shift in the way businesses operate and employees are compensated.

Through the National Tax Strategy Education Program, Justin aims to educate individuals and companies on the benefits of this time-centric approach, highlighting how it can lead to greater employee engagement, loyalty, and a shared sense of purpose. By empowering employees to become stakeholders in the company's future, America's Holding Company seeks to foster a more equitable and sustainable business ecosystem that benefits all involved.

The Future of America's Holding Company: Scaling and Expanding the Vision

As Justin continues to document his journey and share his insights, the future of America's Holding Company looks bright. With a steadily growing subscriber base and the potential to onboard more companies and employees, the company is poised to scale and expand its reach, transforming the way businesses operate and employees are compensated.

Through the strategic use of social media, networking events, and ongoing educational initiatives, Justin is committed to spreading the message of America's Holding Company and inspiring others to join the movement. By demonstrating the tangible benefits of this innovative approach, he hopes to create a ripple effect that will ultimately lead to a more equitable and prosperous future for all.

FAQ

What is the purpose of America's Holding Company?

The primary purpose of America's Holding Company is to revolutionize the way employees are compensated and empower them to become active stakeholders in the companies they work for. By creating a unique ownership structure and educational program, the company aims to foster long-term engagement, loyalty, and a shared sense of purpose among employees.

How does the ownership structure of America's Holding Company work?

America's Holding Company has a three-tiered share system: Class A Shares (19% ownership, 30 votes per share), Class B Shares (30% ownership, earned through active involvement), and Class C Shares (51% ownership, for public trading). This structure is designed to align the interests of employees with the company's growth and success.

Who can participate in the America's Holding Company system?

Both individuals and companies can participate in the America's Holding Company system. Individuals can subscribe at the $27 per month level, while companies can subscribe at various levels ranging from $150 to $2,000 per month, with their employees eligible to receive Class B Shares.

How does the National Tax Strategy Education Program work?

The National Tax Strategy Education Program is an initiative launched by Justin Stephens to educate individuals and companies on the benefits and mechanics of the America's Holding Company system. Through this program, participants learn about the ownership structure, subscription levels, and how the company aims to empower employees and create a more equitable business ecosystem.

What are the long-term goals of America's Holding Company?

The long-term goals of America's Holding Company are to scale and expand its reach, onboarding more companies and employees to the system. By demonstrating the tangible benefits of this innovative approach to employee compensation, the company aims to inspire a paradigm shift in the way businesses operate and create a more prosperous future for all stakeholders.

National Tax Strategy Education Program

Our Joint Education Program with companies to provide for our employees together.

The goal of the National Tax Strategy Education program is to take care of our team throughout time.

Below is the embedded weekly update, and the mission is to update this weekly for the next 100 years.

What is included:

Educational Content created and produced by Justin Stephens

Made in America US Flag

X Community

Month to Month Agreement

HR Support for all employees to become part of our ESOP.

Logo added to our sponsorship page

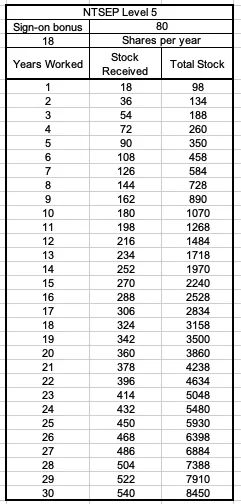

National Tax Strategy Education Program - Level 1

Every employee sign-on bonus: 10 Class B shares of AHCI

Annual Class B Stock Gifts: 2 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $150 per month per company

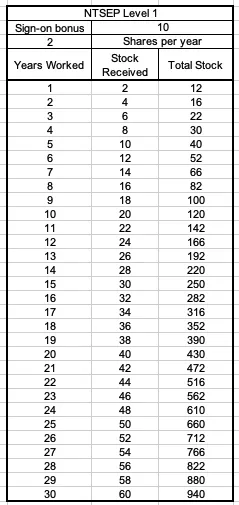

National Tax Strategy Education Program - Level 2

Every employee sign-on bonus: 25 Class B shares of AHCI

Annual Class B Stock Gifts: 4 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $300 per month per company

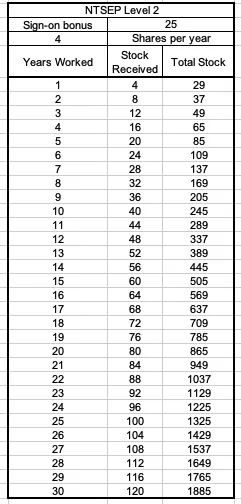

National Tax Strategy Education Program - Level 3

Every employee sign-on bonus: 35 Class B shares of AHCI

Annual Class B Stock Gifts: 5 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $750 per month per company

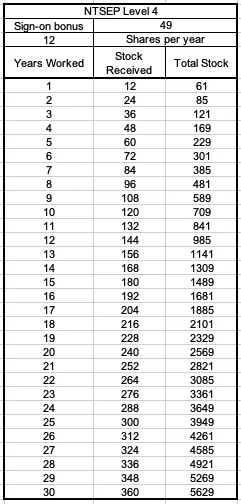

National Tax Strategy Education Program - Level 4

Every employee sign-on bonus: 49 Class B shares of AHCI

Annual Class B Stock Gifts: 12 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $1500 per month per company

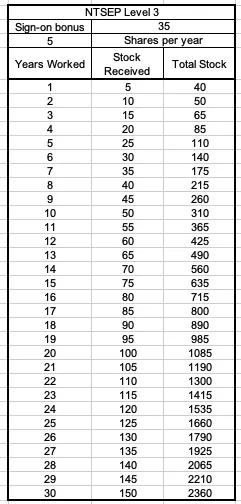

National Tax Strategy Education Program - Level 5

Every employee sign-on bonus: 80 Class B shares of AHCI

Annual Class B Stock Gifts: 18 Class B shares per year

Multiplier: Number of years co-employed with AHCI

Monthly Investment: $2000 per month per company